Ensuring that Pi Network users can seamlessly transfer their Pi Coins to the mainnet requires them to undergo the PI KYC (Know Your Customer) verification process. This essential step enables users to engage in transactions using their minted Pi Coins.

While the KYC process is designed to be user-friendly, many individuals encounter challenges when it comes to uploading documents, completing liveness checks, dealing with machine detection, and more. If you find yourself yet to complete the KYC for Pi Network or facing any hurdles in the process, this guide is here to assist you thoroughly.

Within this article, we’ve comprehensively covered all the prerequisites and steps necessary for a successful KYC approval. Furthermore, we’ve addressed common concerns and frequently asked questions related to Pi Network KYC verification. So, whether you’re a newcomer or experiencing difficulties, this guide aims to provide the clarity you need.

Navigating through the KYC approval process on Pi Network involves a series of steps, and it’s crucial to be aware of the requirements before diving in. Here’s a breakdown of the necessary steps and eligibility criteria:

Requirements and Eligibility Criteria for Pi Network KYC Application:

Age Requirement:

- You must be 18 years or older to proceed with the KYC verification.

Government-Issued ID:

- Have the original copy of one of the following government-issued documents ready, as you’ll be prompted to capture a picture of the ID:

- Passport (recommended)

- Driving License

- National ID

- Note: Instead of uploading a pre-saved ID image, the system requires a live capture during the process.

Clear Face for Liveness Check:

- Prepare for a liveness check by positioning your phone’s camera in front of your face. The system will automatically capture your face to verify your identity against the submitted ID.

- Ensure your face is easily recognizable and matches the one on your ID.

Mining Requirement:

- To be eligible for KYC verification, you must have mined Pi for at least 30 days. This period doesn’t necessarily need to be consecutive.

Time Estimate:

- Plan for approximately 5 to 10 minutes to complete the entire KYC application process.

Understanding and meeting these requirements is the key to a successful Pi Network KYC application. Now, let’s delve into the step-by-step guide to assist you through this crucial verification process.

Note: Although Pi KYC is open for all, eligibility, requirements, and availability may differ from what is shown in this article according to your country or location.

Now, let’s move on to the steps you need to follow to apply for Pi Network KYC verification.

Steps to complete the KYC verification process

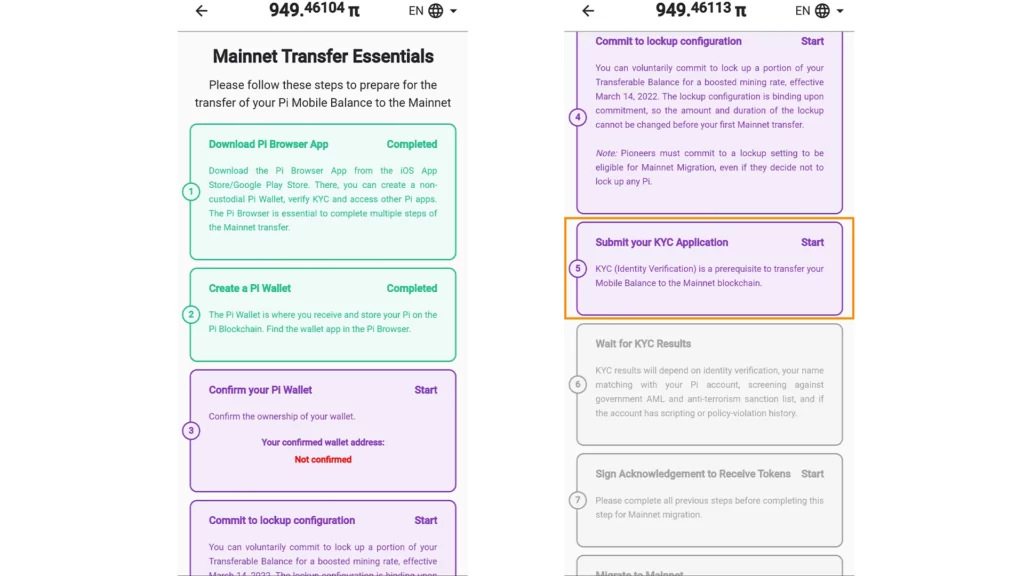

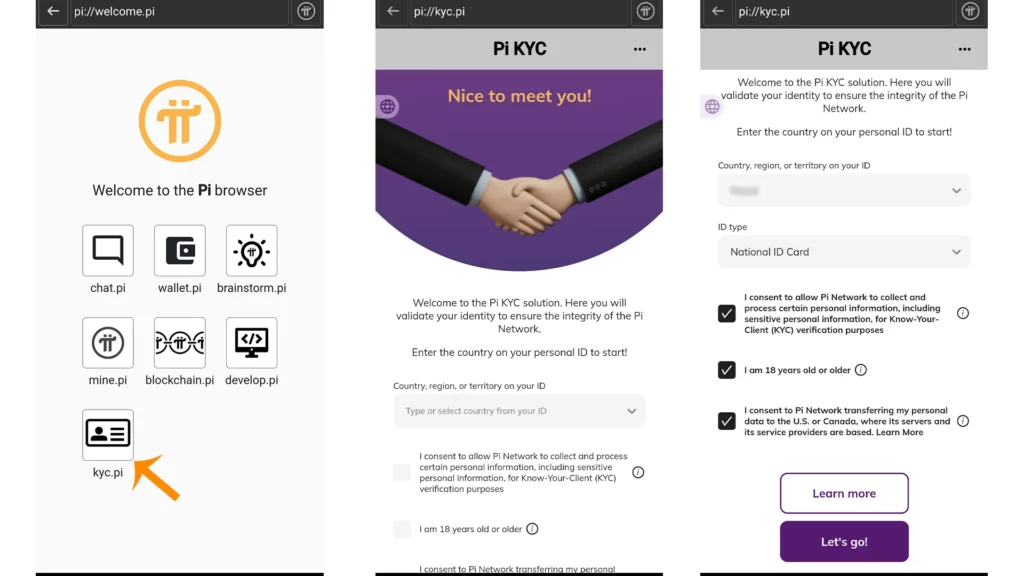

Step 1: Install the Pi Browser app (it is available on the Google Play Store and the Apple App Store). Or proceed to step 2 if you already have it on your device.

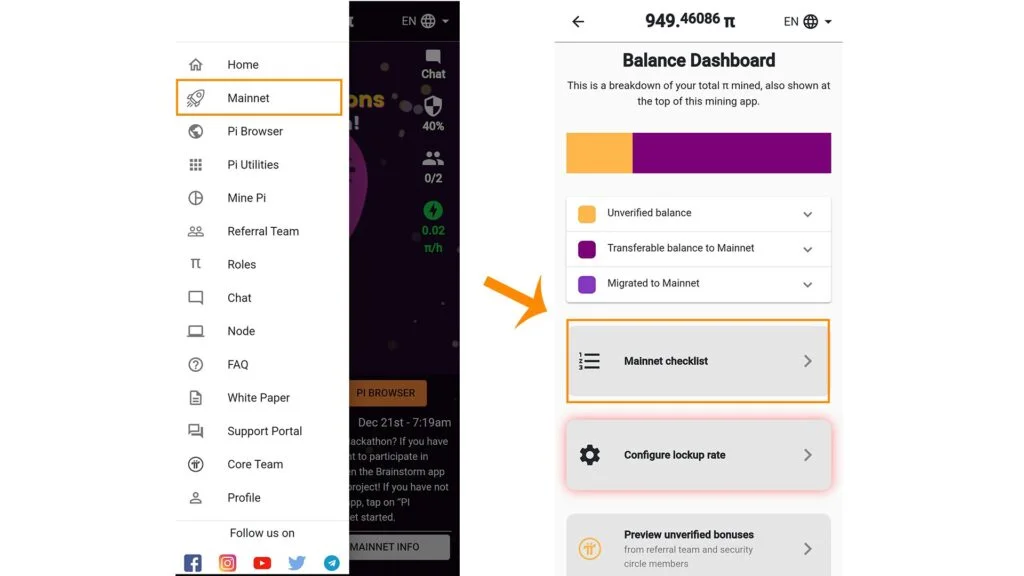

Step 2: Open the Pi Network app and head to the Mainnet section. You can find the Mainnet option in the side menu.

Step 3: Subsequently, tap on the Mainnet checklist tab and complete all the tasks up to the “Submit your KYC Application” task.

Step 4: Once you have finished the tasks listed before the KYC verification, the KYC application tab will be unlocked. Tap on it to start the application process. If it doesn’t work, manually go to the “kyc.pi” area in the Pi Browser app to launch the application process.

Moving forward with the KYC application within the Pi Browser app, here are the detailed steps to guide you through:

Step 5: Upon entering the KYC section in the Pi Browser app, the initial screen prompts you to choose your country from a drop-down menu. Ensure you select the country as per the details on your government-issued ID.

Step 6: Next, specify the type of ID document you intend to use for verification. It’s recommended to opt for a passport.

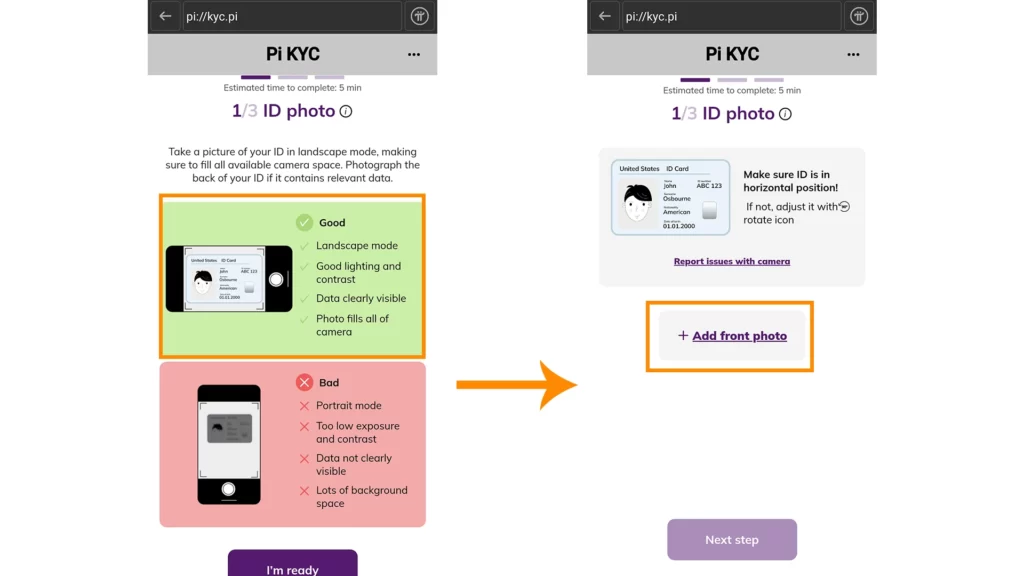

Step 7: Subsequently, you’ll encounter four instructional slides guiding you on how to use your ID and proceed correctly. Carefully read through each slide and tap the next button to proceed.

Step 8: On this screen, you’ll find the option labeled “Add front photo.” Tap on it to activate the camera. Capture a clear image of the front side of your ID. If your ID includes essential information on the back, you’ll also have the option to add a photo of the back.

By following these steps diligently, you’ll successfully navigate the initial stages of the KYC application, setting the foundation for a smooth and accurate verification process. Proceed to the next steps with confidence as we guide you through the entire procedure.

Step 9: After submitting the ID photo, you will be redirected to a form that you need to fill out with the same information as on the ID document.

Providing Details on the KYC Form:

As you progress through the KYC application, the form will prompt you to input the following details:

- First name

- Middle name (optional)

- Last name

- Gender

- Date of Birth

- Document ID number

- Expiry date of ID

- Country of Residence

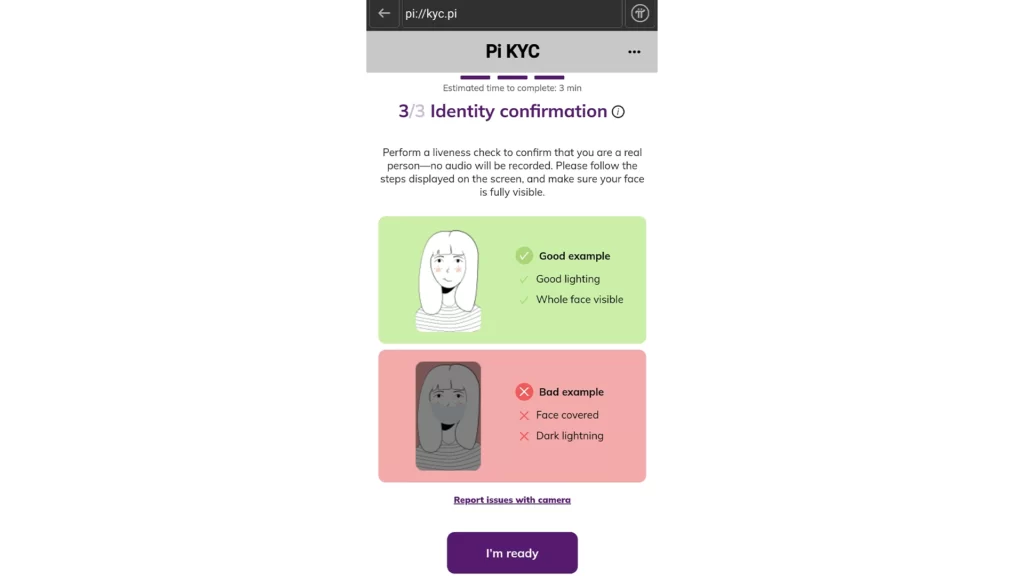

Step 10: After completing the form, the next crucial step involves a liveness check to confirm your authenticity. Follow these instructions:

- Click on the “I’m Ready” button.

- The front camera will activate automatically.

- Hold the camera in front of your face to ensure clear visibility.

This step ensures that the KYC process verifies not only the information you provided but also confirms that you are a real person. By following these steps attentively, you contribute to the accuracy and security of the verification process.

This is all you need to do to verify your KYC on the Pi Network. Continue reading to learn more.

How much time does it take for KYC approval in Pi Network?

The duration for KYC approval within the Pi Network can vary significantly. Here’s an overview of the time frame:

Processing Time:

- After submitting your application, the response time can range from a few days to several months.

Exceptional Cases:

- In rare instances, if you’ve provided accurate information and there are sufficient human validators in your country or location, you may receive verification in just a matter of minutes.

Monitoring Application Status:

- Keep an eye on your application status. It will eventually be either accepted or refused.

Potential Delays:

- If your submitted document lacks clarity, and the automated system struggles to scan essential details like your face, name, or country, you might be requested to capture your ID or take a selfie again.

Patience is Key:

- Understand that the KYC approval process involves various factors, and the time taken can differ based on individual circumstances. Patience is essential as you await changes in your application status.

By staying informed and patient throughout the process, you contribute to a smoother KYC experience within the Pi Network.

How to check Pi Network KYC status?

To monitor the progress of your KYC application within the Pi Network, you have a couple of options:

Checking on Your Profile:

- Open the Pi Network app and navigate to your profile.

- Look for a green checkmark next to the “Identity Verification (KYC)” label. This indicates that your KYC has been successfully verified.

- If you see a loading animation, it signifies that your application is still pending review.

Mainnet Checklist Section:

- Another way to confirm your KYC status is by visiting the Mainnet checklist section.

- If the “Wait for KYC results” tab is displayed in green, it indicates that your KYC has been verified.

By utilizing these methods, you can stay updated on the status of your KYC application and ensure a seamless experience within the Pi Network. Keep an eye out for the green indicators that signify successful verification.

How does the Pi Network KYC application review process work?

Due to the tremendous size of the Pi community, it is highly impractical for the Core Team to perform identity verification for each Pioneer. As a result, they developed a KYC verification system whereby those who have already verified their KYC assist in the verification of others.

Once your documents are submitted successfully, the application goes to someone who is already KYC-verified. After being reviewed by the said person, the application is passed on to another KYC-verified person. If your application passes both validators, you will pass the KYC.

Indeed, the validators will be citizens of your nation, making the verification process considerably simpler and quicker.

For your KYC application, you will be charged 1 PI coin, which will be rewarded to the validators.

To get further information about Pi KYC, you may visit Pi Network’s official KYC FAQs↗ page.

Disclaimer: We have no affiliation with the Pi Network. This article is solely for informational purposes, and we may not be able to resolve individual KYC issues for readers.